Do you have a Venture Capital-style “VC” investment pitch? Trash it. The VC-ecosystem is in DEFCON 1 meltdown, and chasing venture money has always been a colossal waste of time. Only good things are happening here at the West Coast Finance HQ. Let me explain why.

In the world of Venture Capital, everything isn’t as rosy as it might seem. Just yesterday, I spoke with the owner of a $100 million company who took VC money seven years ago.

Let’s call him Joe.

Joe had nothing good to say about his investors. “F&^% those guys, they couldn’t operate a popcorn machine,” he said. Everything went wrong with the company immediately after their money came in. Venture Capital is supposed to fix problems, not cause them.

When new management came in, they didn’t understand the customer, and revenues stalled out and began to decline. That’s when I explained to Joe about West Coast Finance – our vision for building successful companies, not pumping and dumping garbage stocks and crypto coins.

Joe’s response?

“I’m with you. I mean, f**k these VCs. They’ve done nothing but create problems for my brand. It was already on track to be 5x bigger than it is today and generating a LOT more free cash flow for me and my family. I know these VC want out and I want them out. How about you step in and take things over?”

Normally, this kind of conversation takes six months. But here I was, in just three days, writing up a $100 million deal. What did Joe see in my vision that was better than VC or PE?

It wasn’t my magic pitch deck or a sexy valuation with the promise of life-changing financial returns.

It was three simple words: Dedication. Honesty. Hard work.

West Coast Finance is all about relationships and doing the right thing, even if it costs you some money in the short term.

This is the money choice you need to be thinking about: Do I want to roll the dice with some VC brats who will gladly prison-shank me in the back just to juice-up their IRR numbers this quarter? Or, do I want to go with an ecosystem of company builders like West Coast Finance who want to roll up their sleeves, work hard, and launch the next great American company?

Joe learned the hard way that having the right capital partners is key.

Often, this means avoiding VC/PE until WAY LATER when you are actually in control of your own company. VC doesn’t work for me, because what’s the point of having “partners” who create ultra-sexy valuations, get big-time media mentions, and deliver huge check sizes, but are building something that just collapses in the end with no shareholder value for all your years of work?

Today, let’s talk about what REAL investors – as in adults with spreadsheets, not 24-year-old crypto-bros from Stanford – REALLY want to see before writing a check.

Thanks to the recent banking crisis, I’ve spent most of the past week in back-to-back meetings with the who’s who of West Coast Finance.

I’m talking about the regional banks, law firms, and institutional investors that act as the financial backbone for basically everyone outside San Francisco.

Want to know what they’re all asking me about? Where do we find fundable companies that can pass our compliance standards? Despite whatever fears they have about the market, they’re in the money business.

That means no matter what the markets are doing, they have to put money to work in search of returns.

But thanks to a decade of near-zero interest rates and shrinking options in the public markets, trillions of dollars flooded into the private markets.

Want to know what happens when all the money in the world starts chasing after the same finite amount of high-growth startups with the potential for career-defining returns?

Companies that never should have received funding in the first place were getting huge checks at crazy valuations with little to no due diligence.

What goes up must come down. In 2022, it came down hard and fast. The S&P 500 finished 19% lower in 2022 while the Nasdaq dropped 33%.

Just five stocks—Microsoft, Apple, Alphabet, Meta, and Amazon—together lost almost $3.7 trillion in market value over the course of the year. Firms like Tiger Global ate a massive shit sandwich on the way down.

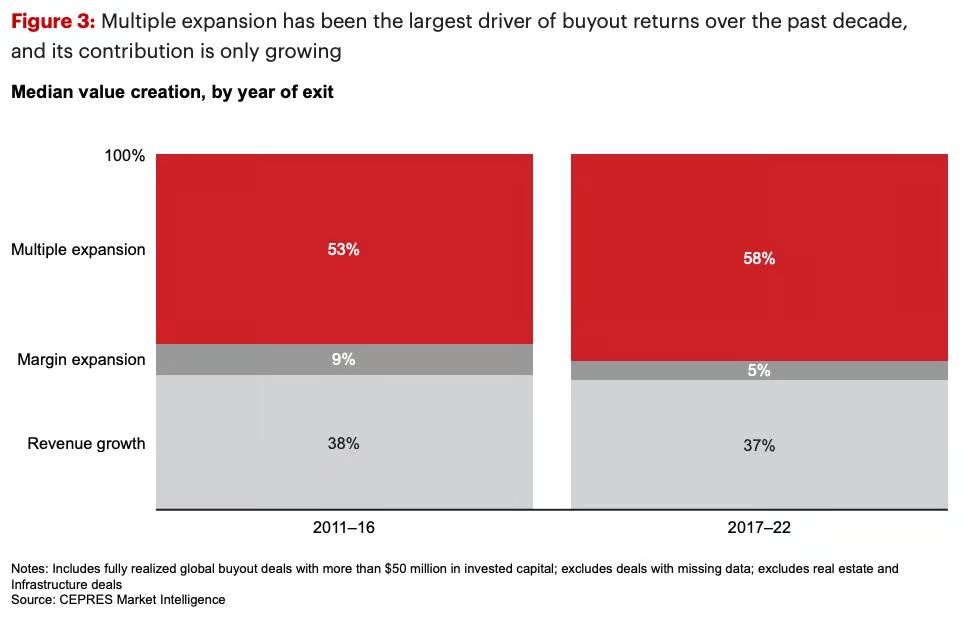

For the entire Era of Easy Money, private equity investors relied on multiple expansions – not margin expansion – to drive returns.

Higher interest rates mean the cost of capital has gone up.

It also means the entire capital markets ecosystem has returned to how finance used to work – valuing companies based on earnings growth.

If you want to drive earnings growth in this changing macro environment, you’re going to need a new playbook.

This is exactly why I launched the Pitch Anything Playbook and took a page out of the original “West Coast Finance” blueprint that started the venture ecosystem as we know it.

Getting everyone who wants to do deals together in a room, agreeing to a certain set of standardized formats, and aggressively teaching capital raising CEOs how to structure their pitch to get funded F.A.S.T.

The game has changed.