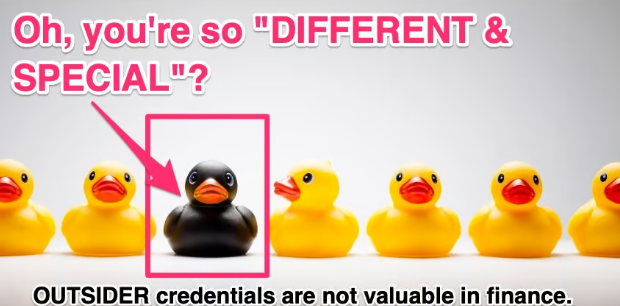

I’ve said this a bajillion times. . . when it comes to the business of money and capital markets, you don’t want to be an OUTSIDER.

When you’re an OUTSIDER in business or politics, you earn cool “Maverick credentials” and therefore, people pay a lot of attention to you.

Yes, it can be fun. You get to act cool, break the rules, and say just about anything you want.

But INSIDERS get all the good meetings, all the best information. . . and they get invited into the best private deals.

If you’re an OUTSIDER to the capital markets, which is probably where you are now, then you have two realistic options for passively growing your wealth:

But consider this third option: when you’re a private market INSIDER, you can use a little-known “backdoor” that can generate 3x, 5x, or even 10x investment returns in 5 years or less. . .

For almost 100 years, THIS private deal playbook and backdoor was only usable by Wall Street insiders and their ultra-rich clients:

Find good quality private companies before they take on professional money.

See, everyone thinks that a good deal is one that “Kleiner Perkins” or “Goldman Sachs” has already invested in.

But this kind of professional money often rigs up the deal so they will get guaranteed fees, no matter what happens. And they’ll work hard to get paid first while YOU get paid last.

The playbook I use has one basic rule: get into a growing company at the right time. . .

So forget about whatever stupid x-shaped patterns the stock gurus are telling you about–the next crypto coin that could return 1,000x, or whatever “easy money” scheme is being promoted right now.

If you’re looking to create family wealth in record time, without taking 100X risks. . .

Then you MUST learn how to use a few surprisingly simple Wall Street Cheat Codes that bankers use to walk into consistent 3x, 5x, and even 10x returns with the least amount of risk possible.

Outside of sheer luck, you–a small balance check writer–will almost always lose the 100x game for one simple reason:

You don’t have access to enough legitimate 100x opportunities to be anything other than “dumb money” in one or two deals.

Here’s what I mean.

Talk to any professional investor, and regardless of whatever gibberish they tell you about their investment thesis, here’s what they actually do: invest in 50-150 companies and hope to get lucky.

No really, that’s it. It’s just a room full of MBAs playing “spin the wheel” trying to get lucky. . . with other people’s money.

But when you’re investing your own money, nothing about VC-style investing makes any sense.

Look at what Paul Graham from Ycombinator wrote on this:

“There is a large random factor in the success of any company. So the guys you end up reading about in the papers are the ones who are very smart, totally dedicated, and win the lottery.”

Here’s why your money shouldn’t compete for 100x deals:

Add to this the data showing the vast majority of funds fail to deliver the promised 3x+ return on capital to their investors. . . but the fund managers get a guaranteed payout.

Keep in mind that these 100X-seeking deals and funds are usually only available to pension plans, endowment funds, insurance companies, and sovereign wealth funds with billions of dollars.

These funds are staffed by an army of MBAs and finance professionals who work 60-80 hours a week to seek out these 100x deals. . .

And they DO NOT want outsiders in their deal.

Why? Because “dumb money” outsiders add ZERO value to the deal–only risk and friction.

Outsiders who don’t understand how deals work in that ecosystem take too long to make decisions, need lots of handholding and education, and simply aren’t worth the effort.

In fact, it’s well established that the only reason “smart money” insiders let “dumb money” outsiders in the deal is because your money is the source of their returns–and guaranteed paychecks.

That’s why if you want to get into high-quality deals, you need to step in from the INSIDER position, ideally through the “10x backdoor” like I do.

To get in through that “10x backdoor,” you need to be a member of an ecosystem that specializes in doing the types of deals you want to be a part of.

Ecosystems are usually located in a geographic region where all of the key players required to build a regional, national, or global firm live and otherwise do deals together.

And in each ecosystem, there is a rare group of individuals who have a unique skill set that gives them access to what I call the “10x backdoor”–a cheat code that gives insiders and elites the best possible returns at the lowest possible risk in every deal they step into.

These people are the BANKERS.

For more than 15 years, I’ve worked as an advisor alongside bankers to more than 250 equity transactions in every single major financial ecosystem you can think of.

During that time, I’ve seen and taken notes on all of the bankers’ dirty tricks–and I know how to do all the work the bankers do to secure those sexy returns.

This gives me and my investors an enormous advantage for one simple reason: we don’t have to pay the bankers’ fees. . . and we don’t have to give up board seats, control provisions, or liquidity preferences that shift risk onto us.

And I am now officially refusing to invest my money in a rigged-up “banker’s deal” only to have all the risk pushed my way!

I’ve learned that you want to be on the side of the deal where WE get to make the rules.

The easiest way to do this? “Unionize” with other investors and create an investment syndication program.

Not only do you get to invest alongside other experienced investors who can teach you the rules of the game. . .

You have some semblance of guard rails in place so you don’t get yourself into trouble.

This is the exact reason why I decided to launch the IPO Factory syndication program: to help small checkwriters learn the “rules” of the game, transition from being an outsider to an insider, and get a seat at the “bankers’ table.”