Here I am at Asher’s hockey practice, but instead of watching my son play, like I should be doing. . .

I’m finishing the website for our investors’ Italy Trip :

But at the end of the day, it doesn’t matter how many Super Bowl tickets or trips to Italy I offer people. There are only two things every investor I know inevitably wants:

Why? Because those are the stories that have the most sex appeal when you talk about them to other people. . . especially at parties.

And my billion-dollar baby won’t disappoint. Here’s why.

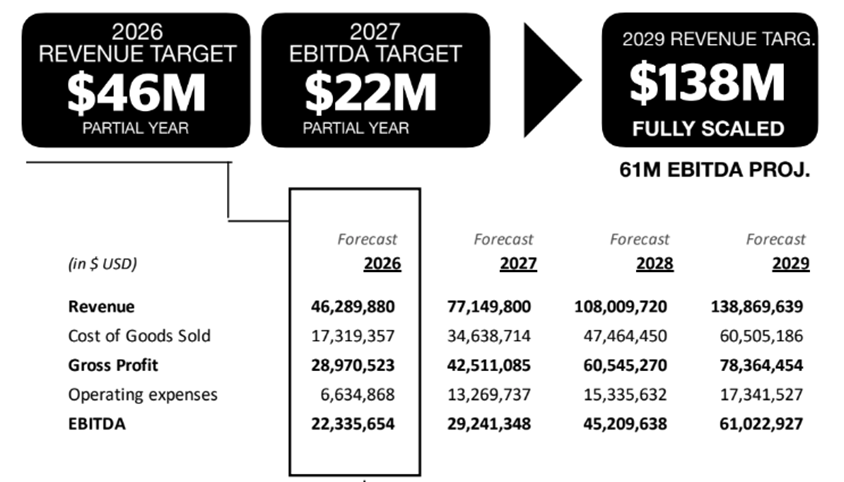

My investors aren’t just rubbing their hands together because our original forecast had us on track to become a $1 billion asset in about five years–though they loved that.

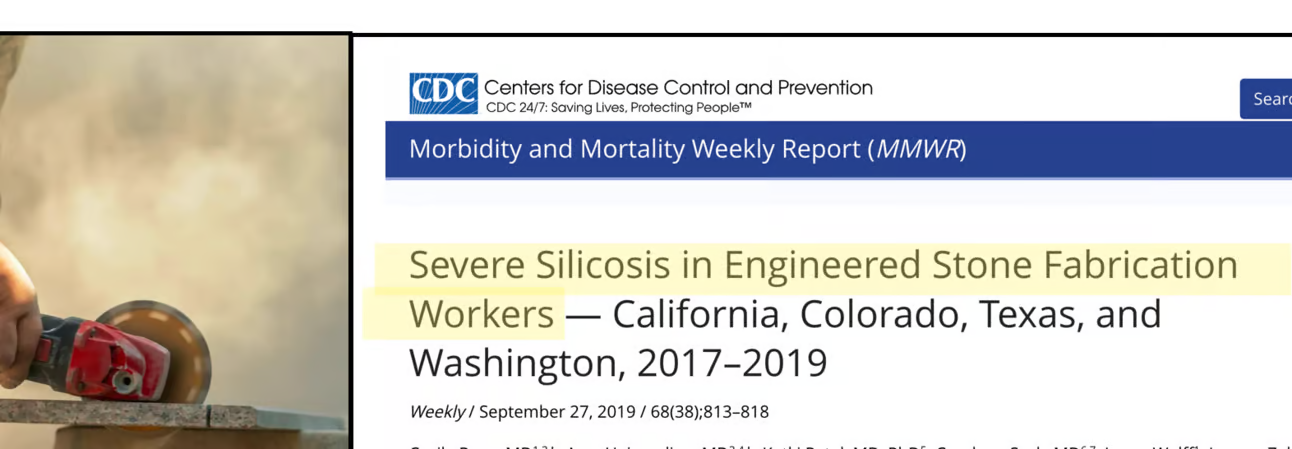

And it’s not even because our engineered quartz solves the silicosis crisis that could harm American workers–though they loved that, too

No, the biggest reason people are so excited is one single competitive advantage – we can make our product using raw materials that are 100% domestically sourced.

We use USA materials ONLY.

And even though most people are either foaming at the mouth for Artificial Intelligence deals or overpriced SaaS. . .

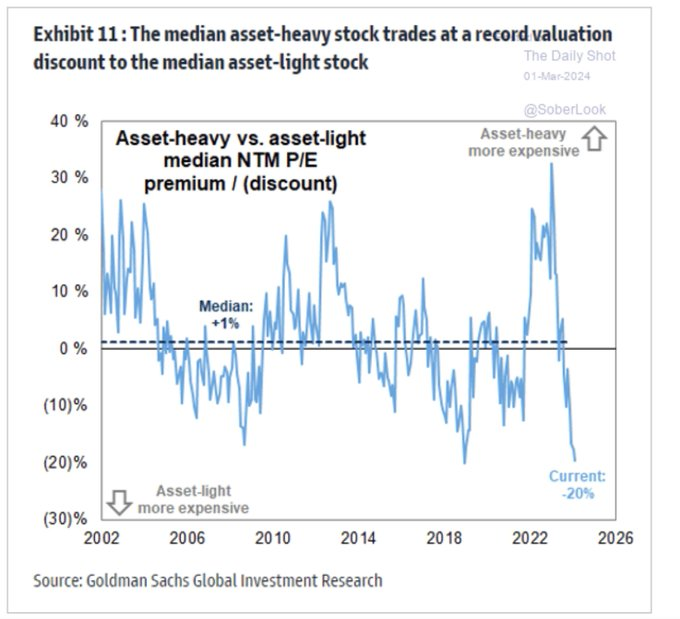

There’s a good reason I’m investing in asset-heavy, next-generation manufacturing facilities instead of sinking my capital into a hot software company with the potential to scale “to the moon.”

Asset-heavy stocks are trading at a discount to asset-light ones.

Here’s why that’s so important to me.

Whether you’re in sales, operations, or capital investing, you want to make money the easy way. And the easiest way to do that? Let the market do some of the work for you.

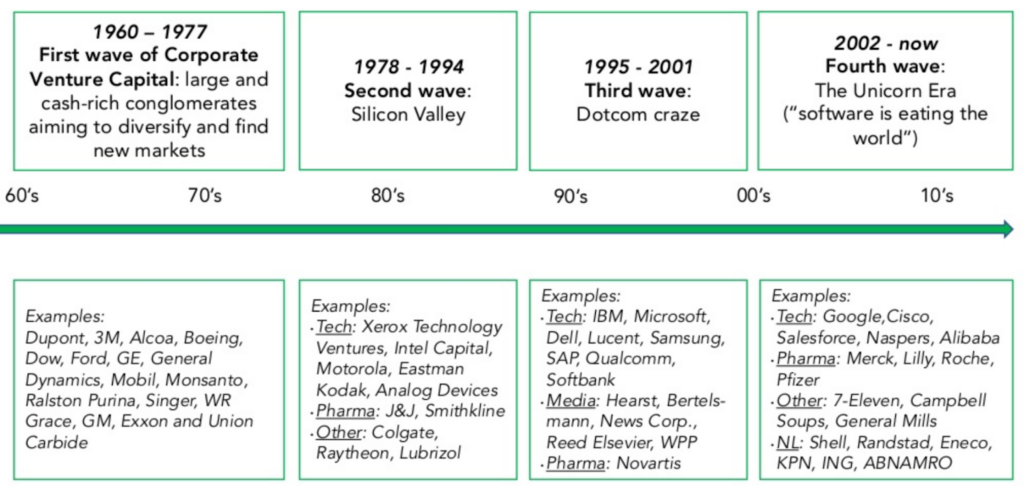

But here’s the thing you have to understand about markets: they move in cycles. And not just the typical boom-bust cycles that happen every 5-10 years. Entire methods of investing go in and out of style every 10-20 years. Take a look:

The “era” you’re probably most familiar with is the most recent: the rise of the “Unicorn.” This is when Silicon Valley mastered its most important narrative, the Myth of the Unicorn Factory.

And it goes something like this: thanks to the magic of software, you too could get rich on the promises of untold future riches. But here’s the problem with Silicon Valley (other than wishful thinking). . .

The Unicorn Factory is closed.

According to Sam Lessin’s “The End of Factory Farmed Unicorns,”

“The VC ‘factory’ line is shut down. It isn’t turning back on. Public demand for ‘factory farmed’ unicorns didn’t play out as hoped.”

The myth that Silicon Valley has the secret formula for making billion-dollar assets out of thin air relied on one simple ingredient that didn’t really come true.

It relied on the assumption there would be infinite demand in public markets for these factory-farmed “Unicorns” after 7-10 years of being stuffed full of toxic money.

Oh, I know what you’re thinking. There were a number of massive winners–a few “real Unicorns.”

Of course there were. And they were concentrated in the hands of the privileged few–the few professional seed stage investors who already lived inside the Silicon Valley Ecosystem and had access to all the cheat codes they needed to rig deals in their favor.

The idea that betting on 10 companies to produce one winner was somehow a solid financial investment strategy–at least, for anyone other than Silicon Valley’s professional seed stage investors– is just ludicrous. Anyone else has no business investing in these kinds of deals.

So why is it I’m so confident I’ve discovered the formula to building a billion-dollar asset in the next five years?

Simple. Instead of pretending like I can guess what the public markets are going to want 7-10 years from now, I’m shooting for narratives I believe will perform well 18-36 months from today.

It’s never been more obvious to me that asset-heavy businesses – especially American manufacturers who can source 100% domestically – are going to have a huge premium on their cashflows in the near future.

In today’s market, our forecast $60 million EBITDA in 2029 might only be valued at a 12x multiple (or ~$720m market cap) in public markets… and it might be valued at 22x and be north of a billion.

One thing I know for sure is that the better AI becomes, the faster it will wipe out whatever moats software companies have. But for companies that are producing highly desirable, high-margin physical goods like we are. . . we think investors are going to place a premium multiple on our cashflows due to how much more defensible our position is.

That’s why I’m 100% focused on investing in US-based manufacturing companies with next-generation IP that can source everything domestically.

That’s the Anti-Unicorn–the secret of the billion-dollar asset with my name on the door. And yours, too, if you invest wisely.