If you’re growing a company and are looking for a $25 million+ exit, keep going. . . but know that the odds are stacked against you.

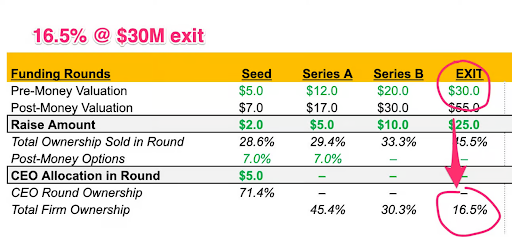

For example, this chart shows a pretty typical outcome after five years of hard labor. You keep 16.5% of $30 million – which is a mere $4.95 million before taxes and fees – after a few rounds of capital dilution:

That’s losing the baby with the bathwater!

But what if you happen to be a founder-led company that hasn’t taken ANY outside funding yet? What are your chances of making a $25 million+ exit?

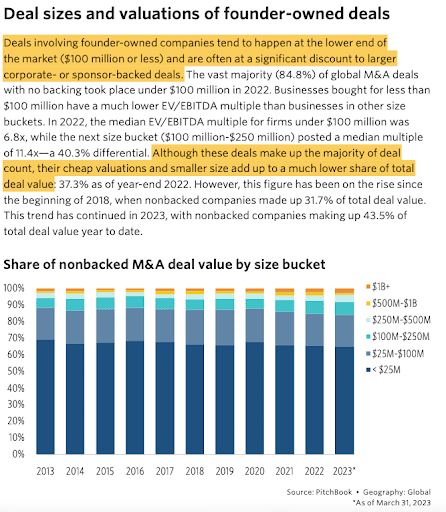

Statistically speaking, these companies have always represented the bulk of the M&A market and are now in even greater demand.

Why? Because market headwinds have caused deal sizes to shrink because EVERYTHING IS SHRINKING.

You must already know that financing big deals has become tougher, which is pushing PE firms and corporations further down-market.

When PE firms enter YOUR market, they are going to run their Secret PE Company Crushing Playbook, which I’m going to describe to you in a minute.

But first, the numbers: according to Pitchbook, the vast majority of non-backed companies sell at a steep discount to corporate-backed deals (e.g. deals with professional money in them). . . and do so for <$25 million!

And even though you might think you’ve got an excellent business that took a lot of time, energy, and money to build. . .

I started my career in capital markets in 2005. Since then, I’ve touched dozens of $100 million+ transactions, both on the buy side and the sell side. . .

And dozens more in the <$100 million category as well.

Even though you probably hear about the eyepopping numbers companies sell for. . .

Very rarely is it the FOUNDER of that company who got rich from that transaction.

In fact, chances are, 12-18 months after founders take in outside money, they are either:

Who actually made all the money in that transaction?

You guessed it: The PE firm who bought the business.

You might think these PE shops are the elite of the investing elite who have some magic fairy dust they sprinkle on deals that makes money fall out of the sky. . .

But the truth is, they’re doing the same thing as 5th graders who go to garage sales on the weekends looking for easy stuff to flip on eBay.

And for all you founders who wind up with what you think is a pretty sweet 7-figure exit…

Here’s what actually happened.

“You did literally all of the hard work, took all of the financial risk, and left basically all of the upside on the table.”

No joke.

Whoever bought your business is going to go for a 5X win over what he paid you, and do it in the next 3 years.

Here’s the basic math:

$4.3 million versus $100 million.

Wait a sec, Oren. How do I avoid this disaster scenario?

Answer: You need a “Map to Money,” and you’ll be fine.

Here’s the thing you need to understand about the Game of Money.

To YOU, the game feels like “Chutes & Ladders.”

When it’s your turn, you spin the dial, move ahead four spaces, and find out whether you stay there or move backward. Then you wait your turn for another spin.

Yeah, when I see companies trying to grow and sell, it really is this clumsy and clunky to watch.

Why? Most founders just don’t have the experience to do it right, as they might sell one company in their lifetime if they’re lucky.

For most PE firms, they are buying and selling dozens of companies every single year.

They know exactly where to go to get all the money they need to make this business work. . .

And chances are, they’ve already done business with all the buyers in the market who could purchase for $100 million+.

More importantly, they understand what that deal has to look like in order to unload it to the next buyer in the cycle.

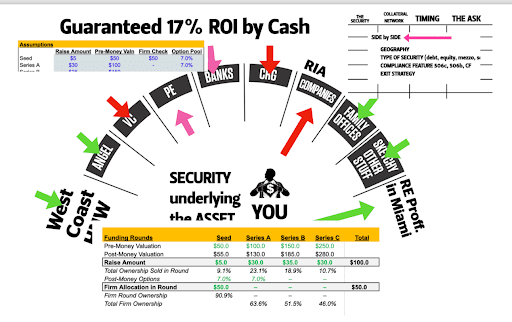

Here’s what an actual Map to Money looks like from one of our working sessions last Thursday. Yes, this is a real deal valued at >$200 million.

But if it’s really that easy to turn your ~$25 million deal into a $100 million deal. . . why would you sell too early and let the PE firm have all the upside?

What if you could simply “copy and paste” the PE firm’s playbook, stay in control, and wind up making way more money on your exit?

Well, you can.

All you need to do is master your strategy, positioning, and offer.

If you’re after a “sexy exit,”

That means either selling the company in a $100 million+ M&A transaction. . .

Or taking the company public at AT LEAST a $250 million market cap (which would officially make you a “small cap” public company).

Regardless of the path you take, chances are that you’ll need to raise several rounds of capital over the next few years to generate the result you’re looking for.

But here’s the thing about raising capital that most people simply don’t understand: The #1 thing you DO NOT want is to have a “stale listing.”

The longer it takes you to complete your round, the harder it gets.

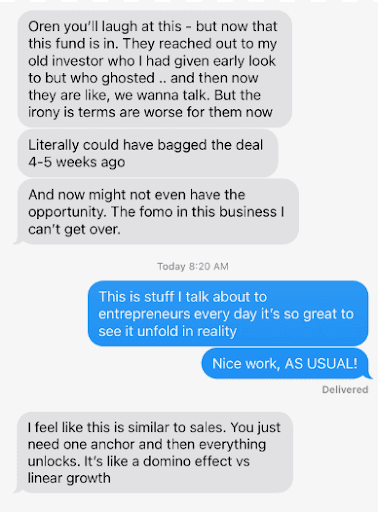

Why? Because investors are far more motivated by FOMO than you think. If other people are putting money into it, they want to put money in, too.

I call this “Capital Velocity” – the faster you raise money, the faster money comes in.

Here’s a real-world example from LAST WEEK:

But back to that three-step process.

To profit, you’re going to have to raise some capital. You’ll have to master origination, pitching, and closing.

But there’s literally no point in you talking to investors until you’ve built your Map to Money, which is a collection of three things:

Seriously, if you don’t have a Map to Money, stop talking about your deal to investors – and start building your Map. NOW.