If you’re serious about multiplying your money—whether you call it “getting rich quick” or “market-beating uncorrelated returns”—you’re probably doing it in private equity.

The playbook here is pretty simple: buy low, sell high, and don’t lose too much money in the middle.

For as long as I’ve been in banking, the single easiest way to “buy low” is to find what we call a “motivated seller.” More specifically, an unsophisticated seller with a quality business asset, who needs money now, and has very few other interested buyers.

In any market, the key to winning is all about managing supply and demand.

If you want to maximize your profits in the dealmaking business, there’s no substitute for acquiring as much equity or control of a sellable asset for as little cost as possible.

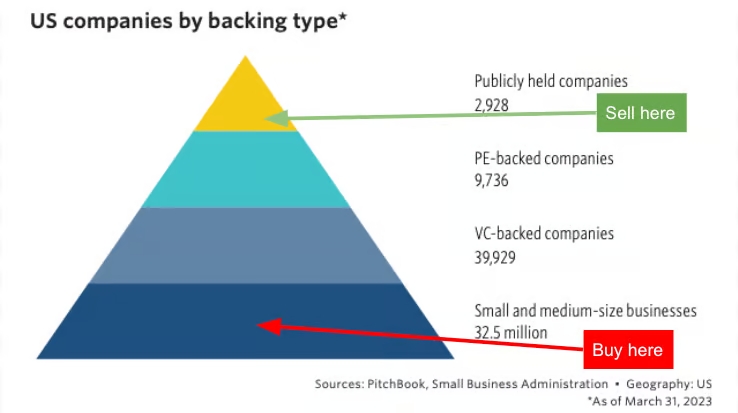

So, where do you find these great businesses that you can pick up below market rates?

Private equity’s favorite hunting ground has always been founder-led businesses that haven’t raised outside capital before. If that’s you, at least “now you know.”

Why are these businesses the perfect targets?

Because most founders lack the executive skill set required to build a business in a way that investors find valuable. On the other hand, the professional investor buying the business most certainly does.

That’s why founder-led businesses often sell for less money and lower multiples than professionally managed deals.

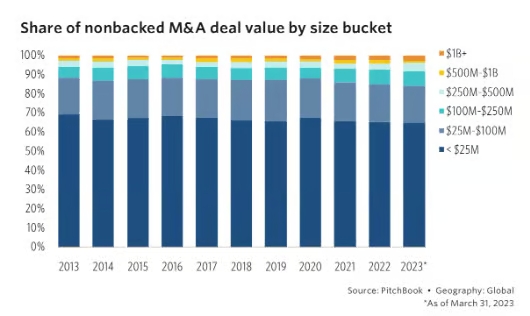

These deals, typically in the lower middle market (under $100 million), are often at a significant discount compared to larger corporate- or sponsor-backed deals.

Acquirers of founder-owned businesses enter these companies closer to the ground floor in terms of value creation opportunities.

One of the primary opportunities is simply scaling the business. Financial sponsors can provide platforms and expertise that these businesses need to tap into new growth areas.

Moreover, many founder-owned businesses carry very little debt on their balance sheets, making them easier to level up financially for acquiring other companies or funding necessary capital investments.

So, what’s the secret to consistently hitting those 5X-10X wins in five years or less?

It’s all about finding these undervalued, founder-led businesses and applying a systematic approach to unlock their potential. But make no mistake—sifting through the vast mountains of garbage-filled founder-backed companies in the lower middle market isn’t easy work.

Institutional investors have entire teams dedicated to originating deals, sifting through the trash, and finding assets that are more valuable in their hands than in the seller’s.

While there’s plenty of risk and hard work involved, structuring the financing the way bankers do can put you—and your investors—in a much lower risk position.

Imagine you’re negotiating a deal: “You think your business is worth $10 million? Well, no, it’s not. You have no other buyers interested except for me. The market rate is $3 million. And even then, you’ll have to provide some seller financing and hit an earn-out target over the next two years.”

Why take such a hard line?

Because unless the business is a well-understood, easy-to-underwrite asset—like a bunch of cash-flowing car washes or Jiffy Lubes—there’s no spot in the market for some sub-$50 million company with messy financials and an owner who can’t explain how the business operates.

When these founders try to sell their company, they often take a deal to market that suffers from the “wrong plug” syndrome.

The deal doesn’t neatly check the “perfect deal” boxes the buyer has in mind, forcing the seller to negotiate with a small pool of sophisticated buyers who understand where the “alpha” is in the deal and are willing to do the work to unlock it.

From the outside, this might look like a predatory financing scheme where assets are “stolen” from people through trickery. But in reality, that’s just how banking works.

Don’t get me wrong—there are predatory lenders out there who do all kinds of nasty stuff, but that’s not how I like to do business.

To consistently hit 10X returns, you’ve got to scrape out every percentage point of return you can.

While your ego might tell you that you can make any deal work, the truth is, you need a repeatable system—some sort of “cheat code” that lets you run the same playbook programmatically.

For me, the deals where I add the most alpha are ones with a well-run business but poorly-run stock.

Unlike the magic required in the stock market to generate alpha, in the lower middle market—sub $100 million companies—things work a little differently.

Forget the “Team with a Dream” propaganda from startup culture.

Real money isn’t made by investing in unproven business models with unproven managers. It’s made by working with experienced executives who have a proven track record of executing the business play you’re financing.

In private equity, great deals are made, not found. But where are those deals made? Not in the middle of nowhere, Kansas.

They’re forged inside innovation ecosystems that support the growth of the business across multiple stages of its lifecycle—places like Silicon Valley, Southern California, Boston, Wall Street, and the Texas Triangle.

Once you understand what an ecosystem is, what types of deals they like to finance, and how to plug your deal into them after you’ve cleaned it up and prepped it for sale, you can “make money on the buy side” of the deal and set yourself up for those 5X-10X returns.

Having done deals in all the major capital markets ecosystems, I know how all their cheat codes work, who the buyers are, and what I need to do to make the deal appealing to them.

And instead of flipping to some PE firm for a quick 5-10X return, my plan now is to do what that PE firm would do on the next leg of the race—take it public myself and get set up for a potential 25X+ return over the next 10-20 years.

-Oren