If you’re like me, you love the movie Top Gun (both of them). That’s why, when I was invited to visit Fightertown USA with my son, I jumped at the chance! We visited the 3rd Marine Aircraft Wing Fighter Attack Training Squadron at Miramar Air Force Base, the same place where the jets from Top Gun were filmed.

For those who don’t follow what’s going on in the defense industry, an air squadron that has been training pilots to fly F/A-18 Hornets for 50 years was recently decommissioned at Marine Corps Air Station Miramar during a “sundowner ceremony,” marking the end of an era for the Department of the Navy.

What’s replacing the F-18? The new $1.7 trillion F-35 platform developed by Lockheed Martin.

We were treated to a full-access base tour to see how America really trains and defends itself. The biggest moment of the day was getting to see the F-35 up close. While photos were not allowed, it was a moment that highlighted how much the defense industry has evolved over the years.

As patriotic as I am about defense, and as appealing as those trillion-dollar government contracts might sound, the truth is, entering the defense industry is an entirely different ballgame.

The ecosystem required to support such deal sizes is immense, and it’s one of the reasons I’ve never pursued financial deals in the defense industry. The process is long, slow, and heavily tied to government operations—a far cry from the fast-paced world of private equity and venture capital.

While the defense industry might be out of reach for many, the lessons learned from such trillion-dollar ecosystems are invaluable.

Over the years, I’ve done deals in nearly every other financial ecosystem: Silicon Valley, Wall Street, Civilian Aviation, MedTech, Genetics, Biotech, Real Estate, Agriculture, Oil and Gas, and even Hollywood.

Each of these industries operates within its unique ecosystem, and mastering the intricacies of these environments has been key to my success.

Just as the military spends trillions developing a platform aircraft to ensure America maintains air superiority, I’ve developed my own platform for wealth-building. I call it the West Coast Finance Ecosystem.

In 2021, I set an ambitious goal of adding $100 million to my personal net worth within five years. To achieve this, I knew I had to elevate my approach to money.

I could continue advising deals and be satisfied with the 7-figure income from advisor fees, but for every $500K fee I earned, I left tens of millions of dollars in transaction value on the table.

The alternative? Putting together my own deals and capturing all the upside for myself and my investors. But there was one problem: I didn’t own any companies, and I’m not particularly good at inventing new products.

Moreover, I wasn’t willing to take on the significant risks associated with entering a new industry with an untested business model, so startups were out of the question.

Given my investment thesis of finding “well-run companies with messy balance sheets and weak ability to raise capital,” there was only one logical place to go hunting for deals: the <$100M middle market.

This is exactly where private equity finds its alpha, and it’s where I decided to find mine.

I started looking for companies that had already figured out their business model, had product-market fit, and ideally, had a management team in place (or one that I could quickly snap in).

It’s hard work, but it’s exactly the kind of work I excel at—raising capital, running financial modeling, growing revenue, and recruiting management teams.

Now, I had an “easy button”: find a good company, come in, and do what I’m good at—the banking stuff. I don’t want to build the plane, train the pilots, or fly the plane.

My job is to create an ecosystem with all the resources needed to pursue the companies I’m interested in, then snap the company into it.

My primary objective is to build the stock of the company into a highly marketable security that can go public within 18-36 months, targeting a return of 5-10X in five years or less.

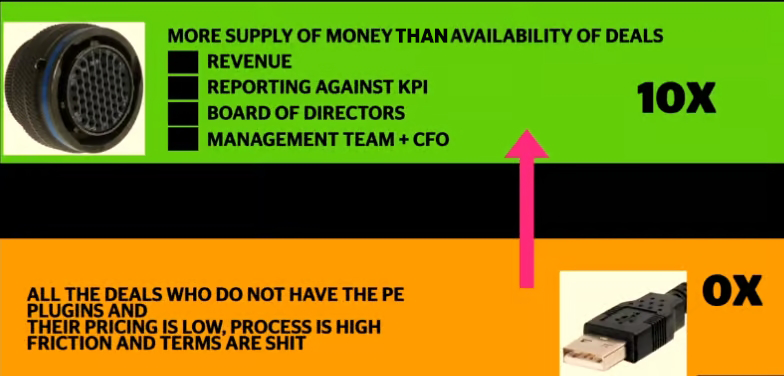

This strategy, which I call the “IPO Factory,” involves taking “Zero X” companies that can’t find any money and placing them into my ecosystem, which—with a lot of work and effort—turns them into 10X deals.

One of the most powerful tools in my arsenal is what I call the Reverse Roadshow.

Traditional roadshows involve an exhausting, coast-to-coast marathon where you meet with every potential investor you can find. I’ve been doing that for 15+ years, but now, I prefer a different approach.

Instead of zigzagging across the country, I put a great story into the market, build interest and excitement around the asset, and invite all the interested buyers into one room at the same time.

This creates an atmosphere that investors love, leading to faster capital raising, better terms, and less risk of not closing on time.

The lessons I’ve learned from trillion-dollar ecosystems, combined with my own approach to creating a platform for wealth-building, have led to significant success in my investments.

By focusing on well-run companies in the middle market and leveraging a diversified capital-raising strategy, I’ve been able to turn “Zero X” companies into 10X opportunities.

This is the future of smart investing, and it’s a formula that’s paying off in a big way.