First Republic Bank had been a solid part of my financial world for over a decade. It was a great partner for my business. Luckily, I had some backup accounts in place, but when JP Morgan swooped in and bought them out, I started thinking more deeply about one question:

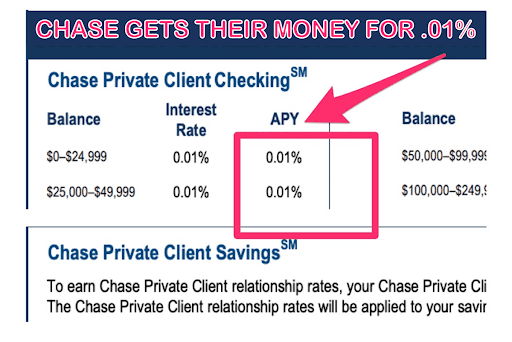

“If banks can get money at 0.01%, why the hell do I have to pay 14% for it… or give up 30% of my company to some venture capitalists?”

That’s when it hit me: this whole mess wasn’t really a crisis for me because I’ve built my own Map to Money over the years. And let me tell you, you need one too.

Here’s the deal. Over the years, I’ve developed a system that helps me understand:

Now, here’s the kicker—the cost of capital is totally different for different people. It’s like milk costing $4 for me, $13 for you, and $0 for Jamie Dimon. When it comes to money, that’s how the world works.

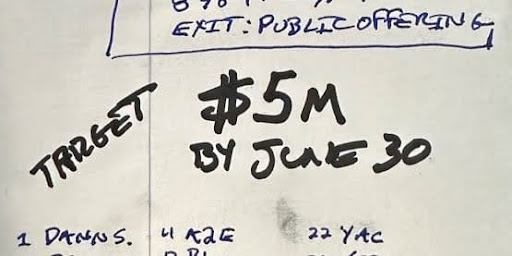

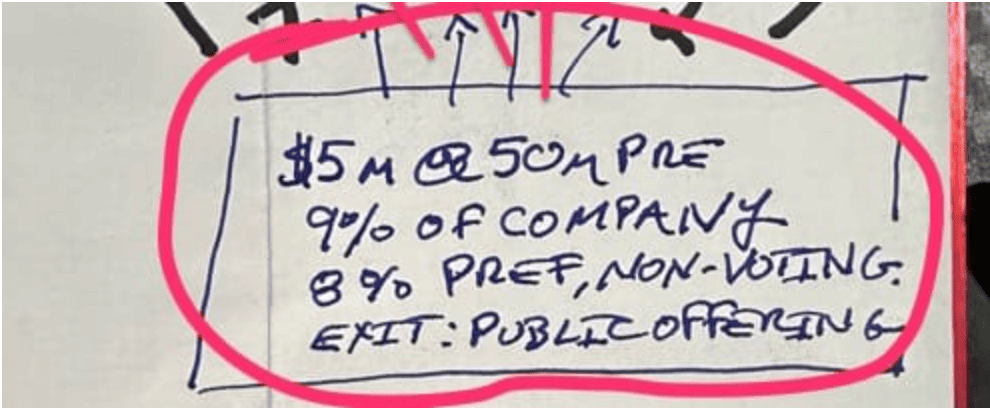

Take my current project as an example. I’m raising $5 million for one of my portfolio companies, OK Stone Engineering, Inc. My “cost of capital” is a 9% dilution, but I’m keeping all the board seats and voting rights.

Now, compare that to one of my clients. They’re raising money for a company at the same stage, and it’s costing them 22% dilution, plus they’re giving away a board seat and voting rights. Why the difference? We’re getting money from different sources, through different channels, and using different offers. And guess what? My choices are better. The proof? My cost of capital is way lower.

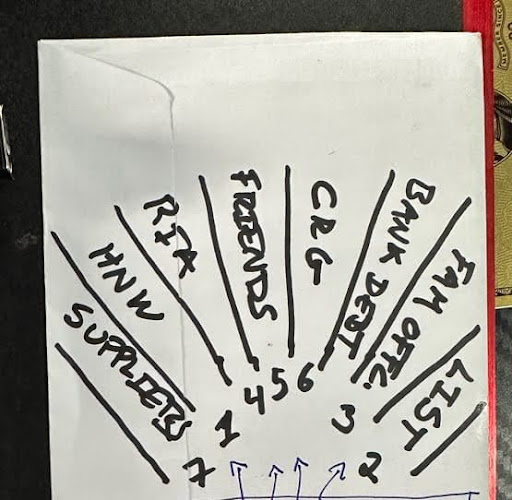

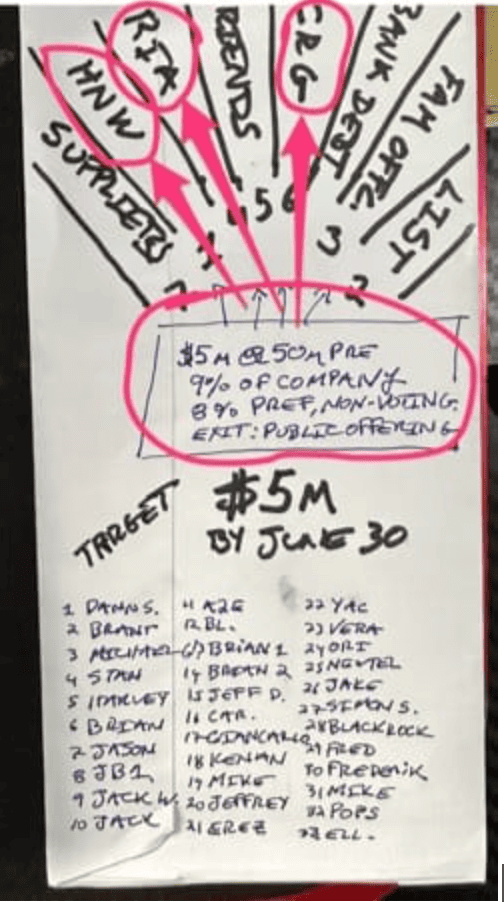

You’ve probably heard many times that a great idea or even a business plan should be able to fit on a napkin. I like to write on the back of envelopes with a big fat permanent marker.

Your Map to Money has 3 core parts to it:

First, what is your financial target, or what bankers call “the capital sources”…

This is both the amount of money you want to raise and what you want to use it for. It doesn’t matter if it’s $50,000 or $5 million – write it down.

Next, write down all the channels that you can source money and working capital from:

My advice here is don’t leave anything out. Throw all possibilities on the paper. For example, maybe you don’t think friends or family are viable channels for you… but once you start talking up your project, I bet your friends will get interested in it. The point is, start thinking about your sources of capital as “channels.”

Here’s a list of the channels that I use to get you started…

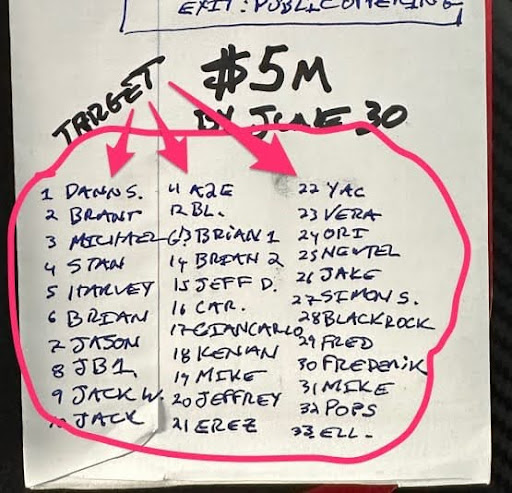

Then list your targets. These are the actual people you know in those channels. I wrote my list free-form, and I know there’s way more than $5 million in these connections.

Here’s where you dig a little deeper into those channels and list everyone you know who fits into one of them. The goal here is to create a list of people you can reach out to and ultimately make a pitch for your investment opportunity.

Here’s what my whole Map to Money looks like for $5 million by June 30th:

Notice that middle section:

That’s the security I’m offering investors.

The arrows show which of my investor channels are most likely to be interested in that offering.

“But I Don’t Want to Ask Friends and Family for Money.”

I hear this all the time: “Oren, I don’t want to ask my friends, family, or business contacts for money!” And my answer? Get over it. Seriously.

Here’s the cold, hard truth: if you’re trying to raise $1 million or less, and especially if this is your first time raising money, we call this the “people you already know” round. Why? Because that’s where you’ll find people willing to take a chance on you.

In future posts, I’ll dive deeper into risk vs. reward and how it factors into your Map to Money, but for now, let’s keep it simple.

Here’s what I want you to do right now. Grab an envelope or a napkin (yes, seriously,) and follow these steps:

The bottom line? If you’ve got a Map to Money, you can raise capital in almost any environment, from almost anyone. So, stop waiting. Pull out that napkin, and start drawing your map today.